|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mechanical Insurance: Coverage Guide for U.S. ConsumersAs vehicle repair costs soar, many U.S. consumers are turning to mechanical insurance to protect themselves financially. This type of insurance, often referred to as an extended auto warranty, provides peace of mind by covering unexpected mechanical breakdowns, saving you from out-of-pocket expenses. Understanding Mechanical InsuranceMechanical insurance is designed to cover the cost of repairs and replacements for your vehicle's mechanical components. It extends beyond the manufacturer's warranty, offering protection even when your original coverage has expired. What's Covered?

Benefits of Mechanical InsuranceInvesting in mechanical insurance can bring numerous benefits:

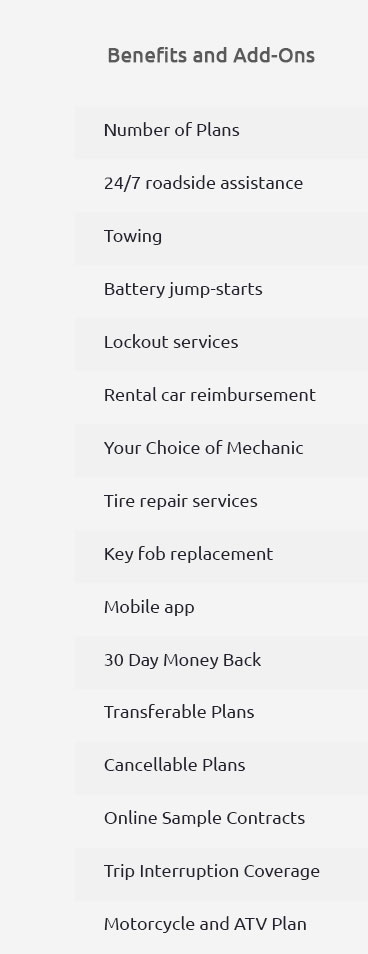

Choosing the Right PlanConsiderationsWhen selecting a mechanical insurance plan, consider the following:

For luxury vehicles, understanding the Mercedes extended warranty cost can help you make an informed decision. FAQsUltimately, mechanical insurance offers a safeguard against unforeseen expenses, allowing you to enjoy your vehicle without the worry of unexpected repair costs. https://www.reddit.com/r/PersonalFinanceNZ/comments/1calfww/mechanical_breakdown_insurance_still_a_waste_of/

A mechanical warranty is a good idea because the product it covers is 'used' already. It's peace of mind for a few years, knowing the maximum ... https://www.joinroot.com/car-insurance/mechanical-breakdown-insurance/

While Root does not offer mechanical breakdown insurance as an option, we do have other coverage types that could benefit you in the event of an accident. https://www.mercuryinsurance.com/insurance/mechanical-protection/

Mercury can help extend the life of your vehicle with a Mechanical Protection plan. These are available for new and pre-owned vehicles and can often cost ...

|